Board of Directors and Expertise of the Board

Philosophy of Corporate Governance at ICICI Bank

At ICICI Bank, we are committed to upholding high standards of governance in all aspects of our operations. We consistently strive to create long-term value for all stakeholders by ensuring comprehensive compliance with applicable laws, rules and regulations, and best practices. Our governance culture is anchored in accountability, transparency and ethical conduct.

Board of Directors and Board Expertise

The Bank’s Board of Directors is broad-based and constituted in accordance with the Banking Regulation Act, 1949, the Companies Act, 2013, the SEBI Listing Regulations, 2015 and global best practices in corporate governance. The Board functions either as a whole or through various committees that oversee specific operational areas.

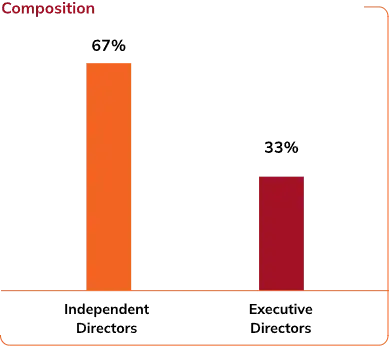

At March 31, 2025, the Board comprised 12 Directors, including eight Independent Directors and four Executive Directors. There were no inter-se relationships among the Directors.

Areas of Expertise

Banking, Finance and Economics

Agriculture and Rural Economy

Accountancy, Business Management, Risk Management and Strategy

Law and Taxation

Insurance, Capital Markets and Treasury

Information Technology

Human Resources

Marketing

Social Sector

Expertise of Independent Directors

Pradeep Kumar Sinha

Neelam Dhawan

Radhakrishnan Nair

B. Sriram

S. Madhavan

Vibha Paul Rishi

Rohit Bhasin

Punit Sood

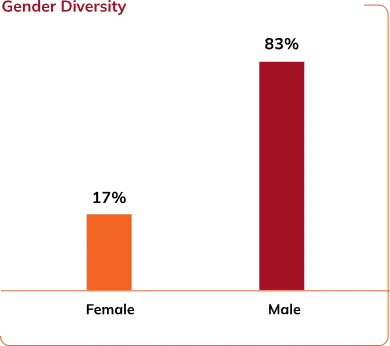

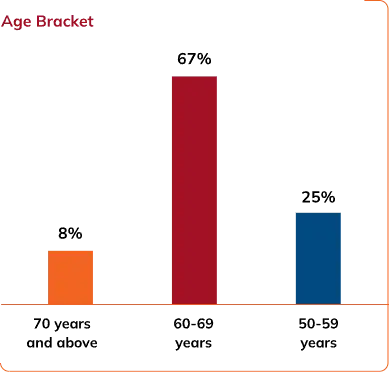

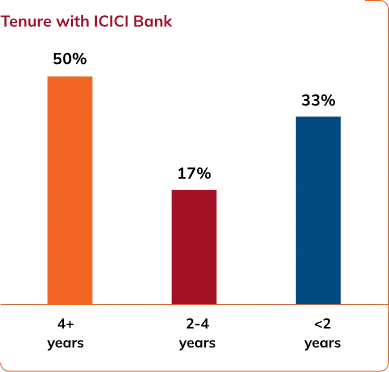

Composition and Diversity of the Board of Directors

All graphs at March 31, 2025

(Best viewed on desktop)

Board Committees and Governance Framework

ICICI Bank’s corporate governance framework is designed not only to meet legal and regulatory requirements but also to embed a culture of ethics, risk awareness, compliance, and value creation. The Bank has instituted comprehensive policies, codes and procedures, implemented through Board Committees, supported by capable people, well-defined processes and enabling technology.

The Board has established 10 Board Committees to monitor the functioning of the Bank and provide necessary direction.

Board Committes

Audit Committee

Board Governance, Remuneration and Nomination Committee

Corporate Social Responsibility Committee

Credit Committee

Customer Service Committee

Fraud Monitoring Committee

Information Technology Strategy Committee

Risk Committee

Stakeholders Relationship Committee

Review Committee* for Identification & Classification of wilful Defaulters

(Best viewed on desktop)

In addition, several executive and senior management committees support operational execution and oversight, such as: Committee of Executive Directors, Executive Investment Committee, Asset Liability Management Committee, Identification Committee (Gross Principal outstanding > ₹750.0 million) for identification & classification of wilful defaulters, Identification Committee (Gross Principal outstanding <= ₹750.0 million) for identification & classification of wilful defaulters, Review Committee (Gross Principal Outstanding <=₹750.0 million) for identification & classification of wilful defaulters, Committee of Senior Management and Committee of Executives, Compliance Committee, ESG Steering Committee, Process Approval Committee, Outsourcing Committee, Operational Risk Management Committee, Vigilance Committee and Product Governance Forum (all comprising Executives from the Bank's Leadership Team). These committees are responsible for specific operational areas like asset liability management, approval/renewal of credit proposals, ESG-related initiatives, approval of products and processes, and management of operational risk, under authorisation/supervision of the Board and its committees.

Committee Governance and Reporting

Each Board committee requires a minimum quorum of three members. When only two members are present, or where the committee comprises two members, any Independent Director may attend the meeting to fulfil the requirement of three members.

Proceedings at these committees are regularly reported to the Board. Board-approved policies serve as the foundation for business operations, supported by independent evaluation, monitoring and reporting structures across the Bank.

Board Independence

The Bank’s governance framework emphasises an independent Board, distinct from executive management. Independent Directors not only form the majority in most Committees but also chair most of them, ensuring effective oversight and impartiality.

In Fiscal 2025, Independent Directors chaired most of the Board Committees. They also constituted a majority in most committees.

Familiarisation Programme for Independent Directors

Independent Directors are familiarised with their roles, rights and responsibilities in the Bank as well as with the nature of the industry and the business model of the Bank through induction programmes at the time of their appointment as Directors. Further, they are regularly kept abreast on key regulatory developments, overview on economy and industry, and the Bank’s strategy and performance. Independent Directors also attend the programmes organised by reputed institutions. The details of the familiarisation programmes are available on the Bank’s website at: https://www.icicibank.com/about-us/bod-1.

Performance Evaluation of the Board, Committees and Directors

The Bank has a formal evaluation framework—approved by the Board Governance, Remuneration and Nomination Committee and the Board—for assessing the performance of the Board, its committees, the Chairperson of the Board and individual Directors. Evaluation is conducted via structured questionnaires based on criteria such as:

- Board Remit

- Board Culture and Communication

- Risk and Compliance

- Board Composition

- Board Relationship with Management

- Ethical Leadership & Corporate Citizenship

- Board Structure and Processes

- Board Relationship with Stakeholders

Further, the evaluation criteria for the Directors is based on their participation, contribution and offering guidance to and understanding of the areas which were relevant to them in their capacity as members of the Board. The Chairperson is evaluated additionally on leadership and effective management of meetings and preservation of interest of stakeholders.

The evaluation of the committees is based on assessment of the clarity with which the mandate of each of the committee is defined, effective discharge of terms of reference of the committees and effectiveness of contribution of the committee’s deliberation/recommendations to the functioning/decisions of the Board.

The Bank uses the services of an external agency for undertaking the evaluation at regular intervals. The fiscal 2025 evaluation was conducted internally and completed to the Board’s satisfaction. The Board of Directors also identified specific action points arising out of the overall evaluation which would be executed as directed by the Board.