Scan this QR to watch the film

Scan this QR to watch the film

ICICI Bank has prioritised customer delight and satisfaction. Its efforts are oriented towards delivering holistic solutions to its customers and building trust that translates into a long-term customer relationships. In line with its Customer 360º approach, the Bank continues to enhance banking convenience by taking the entire bank to the customer. Its initiatives are aimed at streamlining and simplifying the delivery systems and processes through the use of cutting-edge technology. This helps the Bank to improve outcomes and strengthen customer engagement. The Bank steadfastly focusses on delivering products and services to customers through need-appropriate methodologies, underlining its commitment to robust governance, controls and risk management. The Bank aims to become the trusted financial service provider of choice for our customers.

The Bank leverages its business centres network, digital channels, partnerships including overseas coverage of India-linked business to capture the entire Customer 360°.

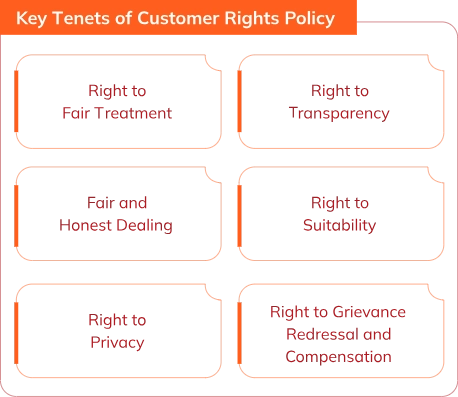

As a customer-centric organisation, the Bank emphasises quality and transparency in all its customer dealings and services. Ensuring seamless customer service and addressing their complaints and grievances promptly and effectively is central to this proposition. A well-established framework is in place to monitor the key customer service metrics at the Bank. The Customer Service Committee of the Board and the Standing Committee on Customer Service (Customer Service Council) regularly review customer service initiatives. The Committees also oversee the functioning of the Customer Service Council. The Bank’s innovation thrust helps to boost customer service quality and enhance the customers’ satisfaction levels. The Bank ensures strict compliance with the 'Customer Rights Policy', aimed at protecting the basic rights of customers. Details of the policy can be accessed on the Bank’s website.

A Board-approved Customer Grievance Redressal Policy lays down the framework for effectively addressing customer grievances. The Bank has diligently defined a robust grievance redressal mechanism, which is structured around the principle of fair treatment without bias for all customers. Its other tenets are transparency in customer engagement and timely resolution customer issues. It provides for a clear turnaround time for resolving the customer’s grievance.

The Bank’s customers can raise their voice through multiple avenues, such as business centres, voice and digital channels. All customer complaints or services requested are recorded in a Customer Relationship Management (CRM) system and tracked for end-to-end resolution. An escalation process is also available to the customer in case of dissatisfaction with the resolution provided by the channel. The Bank follows a well-defined process to manage escalated complaints. An escalation matrix built into the CRM system ensures proper redressal of customer requirements within stipulated timelines. The Bank also conducts a Detailed Root Cause Analysis (RCA) of the issues raised in customer feedback and complaints. The insights gained from the analysis help the Bank improve its products and processes as well as its services. Additionally, in line with the recommendation of the Reserve Bank of India, the Bank has appointed senior retired bankers as Internal Ombudsmen.

Continuous customer education is pivotal to the Bank’s efforts to enhance customer service and ensure transparency in all its offerings. This empowers the customers to make informed choices regarding banking products and services. The Bank tailors its offerings based on a comprehensive assessment of the customer’s financial needs.

The Bank’s Board-level Customer Service Committee, the Standing Committee on Customer Service and the business centre-level customer service committees are tasked with continuous review of customer service across levels.

(Best viewed on desktop)

The Bank is continually enhancing delivery capabilities to provide high-quality customer experiences. While the Bank continues to invest in value propositions in line with the evolving customer preferences regarding products and services, a compelling opportunity emerges to unlock value through simplified banking. The Bank believes this will significantly enhance its capability to serve Customer 360° more effectively and provide a seamless banking experience. Recognising the imperative of simplifying, the Bank, over the years through a series of holistic initiatives, has implemented various measures focussing on decongesting processes, driving digital transformation and strengthening delivery channels to build a seamless and sustainable delivery framework. Continuing on this journey, the Bank is implementing these holistic initiatives across its entire organisational spectrum covering technology, operations, policies, organisational structure, franchise network and distribution channels.

ICICI Bank has established an elaborate system to deal with system-level disruptions. It has established a Customer Communication and Response Committee (CCRC) to contact customers in case of system incidents. CCRC comprises members from relevant stakeholder groups within the Bank, including the customer service, business, channels, technology, corporate brand and communications, risk, credit monitoring, etc. Customers can also contact the Bank in the event of disruption or a disaster through well-defined mechanisms. Details of these mechanisms and processes are available on the Bank’s website.

The Bank places high importance on mapping and measuring the advocacy and satisfaction levels of customers. It uses the Net Promoter Score (NPS) tool to conduct such measurements across key products and touchpoints. The tool helps to measure the customers’ recommendation probability, satisfaction levels with the product/transaction experience, and voice of the customer (VOC).

Around 3.8 million customers were covered annually for their feedback.

The Bank analyses the feedback secured through the mapping exercise and uses the insights to enhance its products, processes and customer services. It also conducts detailed diagnostic customer research in specific areas on a regular basis with the aim of identifying areas of improvement and formulating the necessary actions for the same.

ICICI Bank undertakes sustained efforts to educate customers on safe banking and cybersecurity. Awareness initiatives are conducted regularly through multiple channels, including social media platforms, in-app notifications, emails, and SMS, to inform customers about secure banking practices and emerging fraud trends.

Views

Likes

In fiscal 2025, the Bank launched the third edition of its flagship safe banking campaign—“#BeatTheCheats”, a comprehensive public awareness campaign addressing the most prevalent frauds. This edition focussed on the parcel fraud and the investment fraud, two of the most prevalent frauds both in terms of volume of occurrence and value of loss.

Structured as a two-part series, it featured National award-winning Indian actor Tabu in a dual role, helping educate customers on the modus operandi of these frauds and the steps they can take to protect themselves. The campaign was disseminated across TV, social media, OTT platforms and outdoor hoardings in top cities across the country. It also featured during the ICC Champions Trophy in March 2025.

Scan this QR to watch the film

Scan this QR to watch the film