ESG Governance

ICICI Bank's approach to ESG is anchored in the pursuit of long-term sustainable growth, driven by strategic business initiatives and responsible corporate practices. By integrating sustainability into its core operations, the Bank seeks to generate positive environmental and social impact, while delivering strong financial performance. ESG-related aspects are embedded within the Bank’s overarching business strategy, underpinned by its guiding principles: ‘Fair to Customer, Fair to Bank’ and ‘One Bank, One Team’. These tenets govern the Bank’s conduct in customer service, employee engagement, and pursuits of environmental objectives.

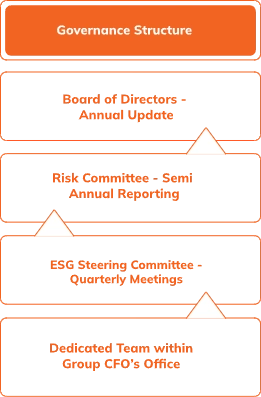

The Bank has instituted several Board-level committees to steer its ESG agenda. The Risk Committee provides strategic direction and oversight on ESG matters, including environmental sustainability, climate-related initiatives, and associated risk. The Corporate Social Responsibility (CSR) Committee oversees the Bank’s social responsibility programmes. Other committees, such as the Audit Committee and the Stakeholder Committee, are tasked with managing ESG-related aspects within their remit and submit updates to the Risk Committee on those areas.

At the management level, an ESG Steering Committee—chaired by the Group Chief Financial Officer and comprising senior functional heads from the Bank's leadership team—reinforces the Bank’s ESG efforts. Its responsibilities include review of key policies, initiatives, targets, and disclosures, as well as periodic reviews of progress across ESG dimensions. In the fiscal, ESG Steering Committee held seven meetings for oversight on the Bank's initiatives.

In fiscal 2025, the Bank made progress across ESG dimensions through targeted interventions aimed at strengthening practices and advancing towards meeting sustainability goals. This year’s priorities included enhancing data management, and enabling more efficient tracking of key metrics, including alignment with disclosure frameworks. The focus was on aligning sustainability actions with the overall business priorities and regulatory expectations. The Risk Committee and the Board were regularly updated on the progress of ESG-related regulatory developments in India and jurisdictions where the Bank has a presence as well as the initiatives taken during the year.

ESG Governance

(Best viewed on desktop)

ESG-related Initiatives in Fiscal 2025

Evaluating and Managing Emissions in Own Operations

Achieving carbon neutrality in Scope 1 and Scope 2 emissions from own operations by 2032 remained a key priority. As an interim step towards offsetting emissions, the Bank procured International Renewable Energy Certificates (IRECs) equivalent to 11,000 MWh, backed by mix of wind and solar power. Including IRECs, renewable energy accounted for 38% of total electricity consumption from grid and solar sources in fiscal 2025. The Bank’s aggregate Scope 1 and Scope 2 emissions (excluding IRECs) increased by 16% during fiscal 2025, primarily due to severe heatwaves across Northern India, resulting in higher electricity usage, and expansion of office space aligned with business strategy.

Prudent Resource Utilisation

The Bank installed Atmospheric Water Generators (AWG) at four additional locations during the year. This facility is now available at five large premises with a potential to produce daily output of 8,000 litres of potable water.

Several steps have been taken towards reducing paper consumption and converting to recycled paper. The Bank increasingly procures BIS Eco Mark-certified A4 paper, while over 79% of pre-printed forms used at business centres now consist of FSC-certified recycled paper.

Strengthening Risk Management Practices

The Bank continued enhancing identification and management of ESG and climate-related risks. This included curating and consolidating data required to estimate financed emissions. The sectoral coverage of the checklist used for capturing borrower-level data on ESG and climate-related parameters were extended to 20 from 16.

Occupational health and safety measures were improved by reinforcing risk assessments, safety training and incident reporting mechanisms. In fiscal 2025, three new locations received ISO 45001 certification, taking the total to 21 premises, including large offices, call centres, data centres, learning centre and staff quarters.

ESG Data Architecture

The Bank remains cognisant of the importance of robust ESG data governance and the need to adapt IT systems to enable systematic collection, aggregation, and reporting of key ESG metrics. In fiscal 2025, a digital tool was introduced to streamline ESG data management, including calculation of emissions across categories, targeted monitoring, and comprehensive reporting.

Employee Well-being

Through continuous engagement with employees, the Bank continues to foster ESG awareness. The capabilities of key teams were further strengthened through knowledge-sharing sessions by external agencies and workshops facilitated by regulators.