ICICI Bank’s Values

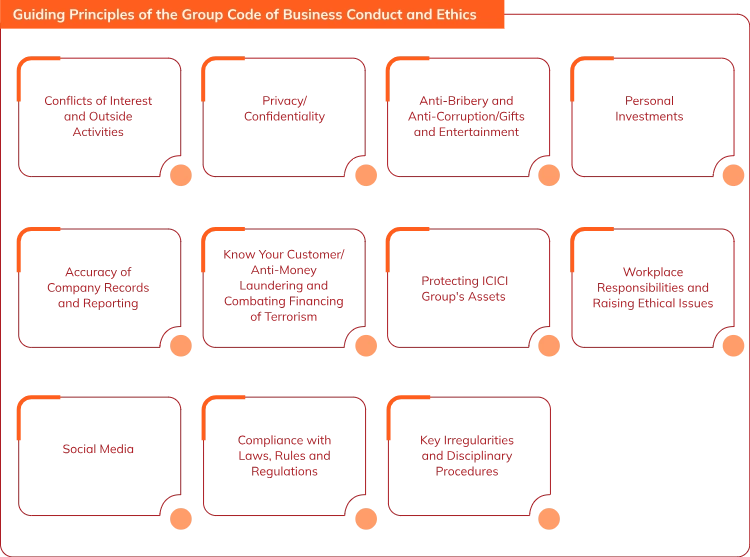

ICICI Group Code of Business Conduct and Ethics

ICICI Bank is committed to acting professionally and fairly in all its dealings. ‘The ICICI Group Code of Business Conduct and Ethics’ encapsulates the values, principles and standards that guide the decisions and actions of all employees at the Bank. This Code is also the Bank’s commitment to its stakeholders to uphold the high ethical standards and dealing with integrity.

ICICI Bank has embedded compliance with high professional, governance, legal and ethical standards into its business ethos.

Mandatory training and e-learning modules on the Code of Conduct, Information Security, Anti-Money Laundering and other critical and sensitive compliance-related areas are provided to all new employees. The Bank reviews the Code annually, and the updated Code can be accessed on the Bank’s website.

(Best viewed on desktop)

Anti-Bribery and Anti-Corruption Policy

In addition to India specific regulations like the Prevention of Corruption Act, 1988 (POCA), several international provisions are applicable to the Bank in view of the global nature of its operations. These include the Foreign Corrupt Practices Act (FCPA) several key international and domestic provisions are applicable to the Bank in view of the global nature of its operations. These include the Prevention of Corruption Act, 1988 (POCA) in India, the Foreign Corrupt Practices Act (FCPA) in the United States of America, and other similar applicable anti-bribery regulations, as amended from time to time, in other jurisdictions where the Bank conducts its business.

The Bank follows a strict zero-tolerance policy for bribery and corruption. It is committed to professional and fair conduct with transparency and integrity in all its relationships and business dealings in every region of its operations. A comprehensive Anti-Bribery and Anti-Corruption Policy outlines the expectations from the Bank’s employees and vendors in this regard. The policy requires the vendors to submit an annual self-declaration to the Bank reaffirming their compliance with the policy.

ICICI Bank reviews the policy on an annual basis. The policy is also subjected to an external risk assessment at least once every three years. Such assessment was last conducted in fiscal 2024, and no material gaps were identified. The Bank has established a Vigilance Committee to evaluate all issues related to bribery and corruption.

Whistle Blower Policy

ICICI Bank’s Whistle Blower Policy provides all employees (including directors), secondees or stakeholders with a safe avenue to raise concerns about breaches of law or accounting policies or any act resulting in financial or reputation loss and misuse of office or suspected or actual fraud. It has been established in compliance with the requirements of the vigil mechanism as stipulated under Section 177 of the Companies Act, 2013 and other applicable laws, rules and regulations. Details of the policy is available on the Bank’s website.

The policy, which is periodically reviewed and communicated to the employees, is also posted on the Bank’s intranet. It provides designated channels for reporting such concerns to the Audit Committee. The Bank ensures proper investigation of all issues raised under the Whistle Blower Policy or shared with the senior management. Such investigation leads to the formulation of appropriate action, including an assessment of the impact on financial statements, if any.

The policy protects whistle blowers for the duration of their employment at the Bank or its subsidiaries. ICICI Bank protects the identity of the whistle blowers in all cases. It does not allow any retaliation or discrimination attempt to disadvantage any person who has reported genuine and grave concerns regarding an apparent wrongdoing.

Group Anti-Money Laundering and Combating Financing of Terrorism Policy

ICICI Bank does not allow money laundering or financing of terrorism by its employees or any entity engaged with the Bank. This is governed by a Board-approved Know Your Customer (KYC), Anti-Money Laundering (AML) and Combating Financing of Terrorism (CFT) Policy.

The Bank adheres to strict AML standards and ensures their compliance through Know-Your-Customer (KYC) and monitoring/reporting of suspicious transactions. The KYC, AML and CFT Policy set out for a risk-based strategy for adherence to the AML standards. It lays down pre-defined rules in accordance with regulatory guidelines for monitoring all financial transactions. A mechanism is in place for prompt submission of any suspicious transactions to the concerned reporting authorities.

A well-crafted name screening procedure helps the Bank to ensure that the identity of a customer does not correspond to any individual with a known criminal background or with sanctioned/banned entities. The Bank also maintains detailed lists of individuals or entities issued by the Reserve Bank of India, the United Nations Security Council, other regulatory or enforcement agencies, legislations or internal lists, as the Bank may identify from time to time, to prevent proliferation financing/terrorism financing. The Bank undertakes elaborate screening of names/parties involved in a transaction against sanctions lists as specified above and other negative lists, as applicable at the time of transaction.

The Bank takes care to keep its employees updated and aware of the various measures in place to prevent money-laundering or terror financing. It organises periodic training sessions and also disseminates information mailers to promote such awareness.

The Bank reviews its governance practices and frameworks on an ongoing basis and takes necessary actions to adapt or update them in response to any changes in the evolving business and regulatory landscape. It remains steadfastly focussed on protecting the interests of all its stakeholders.

The Bank continuously focusses on effectiveness of financial controls and assesses compliance with all relevant regulatory requirements. Key policies of the Bank are reviewed and enhanced to ensure relevance, adherence to regulations and adoption of best practices on an ongoing basis. The Board-approved Group Compliance Policy lays down the compliance framework with emphasis on ensuring that products, customer offerings and activities conform to rules and regulations while adhering to the Bank’s ethos of ‘Fair to Customer, Fair to Bank’.

Human Rights Policy

The policy underlines ICICI Bank’s commitment to promote and respect human rights and aims to provide a work environment that respects and upholds individual dignity. The Human Rights Policy of the organisation is aligned to the United Nations Guiding Principles on Business and Human Rights (UNGP) and International Labour Organization’s Declaration on Fundamental Principles and Rights at Work. ICICI Bank believes in the corporate responsibility in promoting and safeguarding internationally proclaimed human rights. The Human Rights Policy aims to create awareness, promote and redress grievances in the following areas—Safe and Harassment Free Workplace, Free from Sexual Harassment, Diversity and Inclusion, Freedom of Expression, Free from Child and Forced Labour.

Equal Opportunity

The Bank’s commitment to nurturing and promoting a culture of diversity, equity and inclusion enables employees to work effectively, free from any biases. The objective of the diversity, equity and inclusion (DE&I) policy is to:

Link to other policies of the Bank: https://www.icicibank.com/about-us/other-policies

- Policy for appointment of statutory auditors of the Bank under Indian GAAP

- Policy for determining Material Subsidiaries

- Policy for determination of materiality

- Related Party Transactions Policy

- Archival Policy

- Dividend Distribution Policy

- Compensation Policy

- Code of Practices and Procedures for Fair Disclosure of Unpublished Price Sensitive Information

- ESOP disclosure

- Information about Whistle Blower Policy / Vigil Mechanism

- Environmental, Social and Governance (ESG) Policy

- Policy for Investors for claiming unclaimed amounts for ICICI Bank Bonds

- Framework for Managing Conflicts of Interest (Abridged version)

- Anti-Bribery and Anti-Corruption Policy (Abridged version)

- Group KYC, AML and CFT Policy (Abridged version)

- Framework of the Corporate Tax Policy