Disciplined execution with focus on capital, counterparty and capacity to deliver sustainable outcomes.

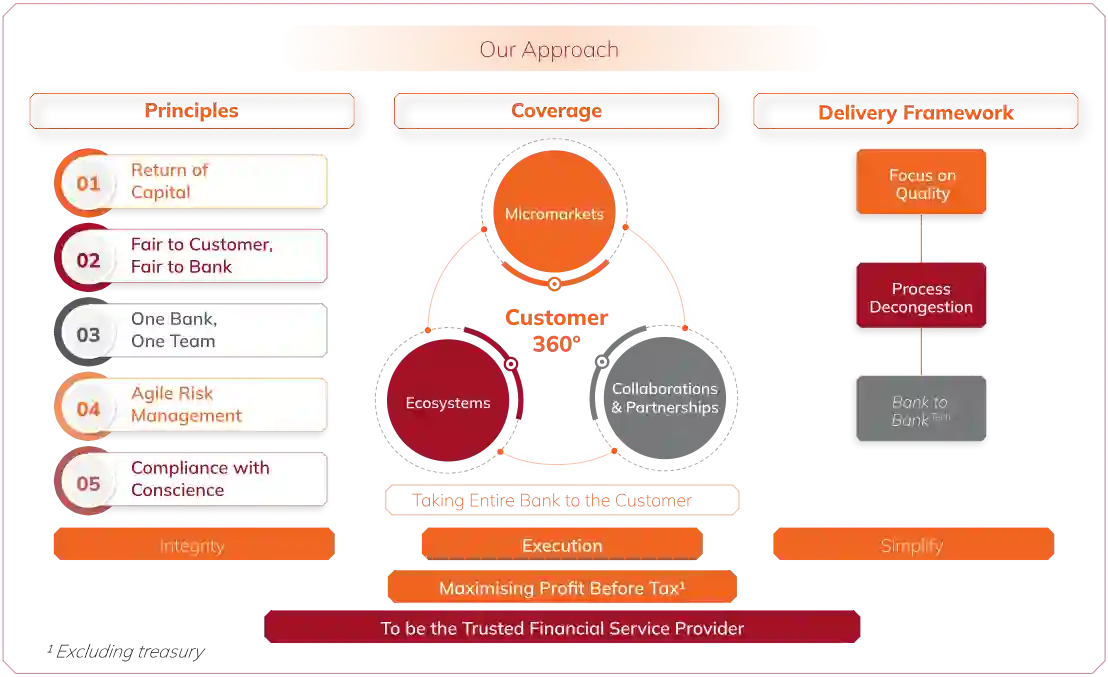

As we mark 70 years of service in fiscal 2025, the Bank progresses on its sustainable growth journey underpinned by disciplined focus on profitable growth, consistent execution, deepening customer-centricity as well as building capabilities. The strategic approach continues to remain anchored on pillars of principles, coverage and delivery framework. The core principles of ‘Return of Capital’, ‘Fair to Customer, Fair to Bank’, ‘One Bank, One Team’ and ‘Compliance with Conscience’, continue to guide our dealings with all stakeholders while pursuing our business objectives.

The Bank continues to maintain its strategic focus on profit before tax excluding treasury within the guardrails of compliance and risk management. The Bank’s profit before tax excluding treasury grew by 11.4% year-on-year during fiscal 2025 to ₹607.13 billion. The Bank continues to grow its loan portfolio in a granular manner with no specific targets for loan-mix or segment-wise loan growth. During fiscal 2025, the Bank delivered broad-based loan growth across segments of 13.9% year-on-year in the domestic loan portfolio to ₹13,109.81 billion. The Bank continues to grow its liability franchise, maintaining a stable and healthy funding profile and competitive advantage in cost of funds. The deposits grew by 14.0% year-on-year to ₹16,103.48 billion. The Bank continues to focus on maintaining a resilient balance sheet with adequate liquidity, prudent provisioning and healthy capital adequacy.

Selection of right counterparties and focus on capital preservation continue to underpin our efforts to pursue opportunities across ecosystems and micromarkets. Embracing agile organisation structures and enhancing the delivery framework enable us to deepen 360º engagements along with improved customer service.

With a long-standing franchise in place, the Bank aims to realise its rightful market share by harnessing brand and leveraging core strengths.

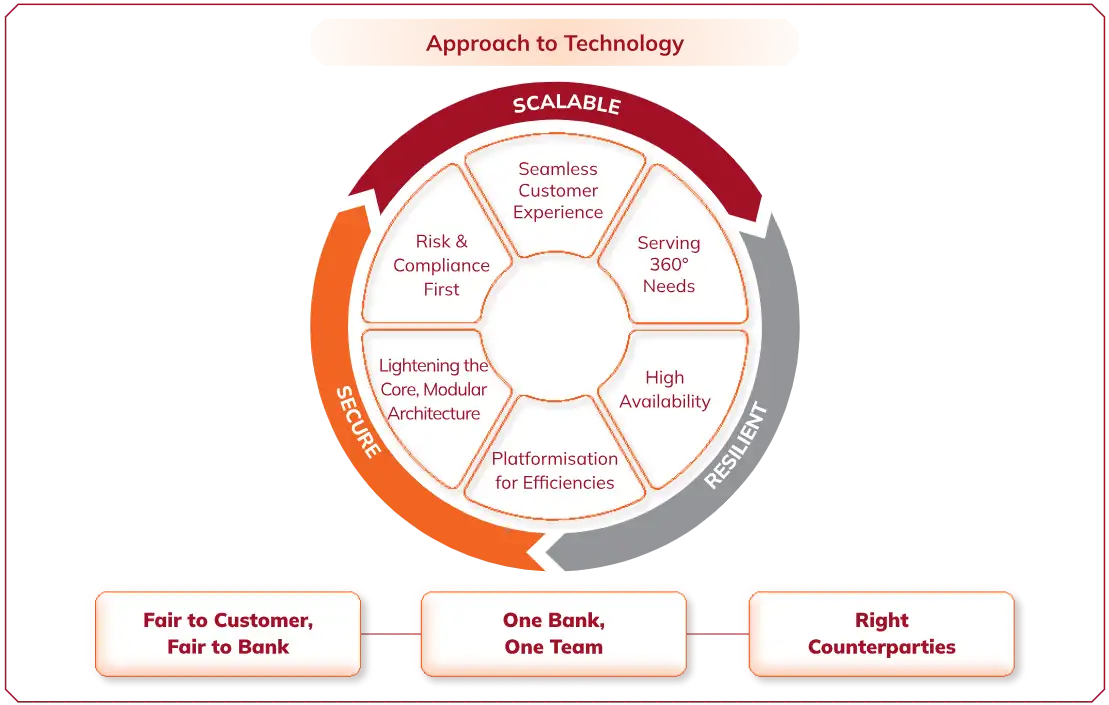

The Bank is committed to and continues to invest in strengthening operational resilience and delivery channels, ensuring secure, stable and resilient banking platforms. Offering quality banking with simplicity and reliability is the key priority to enhance customer engagement and seamless experience. Integrity, transparency and fairness continue to be core in serving customers and offering suitable banking solutions that support long-term sustainability. As we work towards realising our vision of becoming the trusted financial service provider of choice for our customers, we remain focussed on creating sustainable value for our stakeholders.

Building trust with all stakeholders is fundamental to the Bank’s strategic objectives.

The Bank recognises the importance of a robust framework and is committed to fostering a healthy culture of risk and compliance. The Bank continuously endeavours to strengthen its culture and all employees are encouraged to align with these guiding principles in their activities while representing the organisation.

The Bank is focussed on the principle of ‘Return of Capital’ emphasising the need to prioritise conservation of capital. The approach of onboarding the right counterparty has provided an impetus to resilient growth in business while protecting capital. Capital preservation involves prudent risk management and effective capital allocation to sustain long-term growth and stability. The Bank focusses on growing its loan portfolio in a granular manner with a focus on risk and reward.

The principle of ‘Fair to Customer, Fair to Bank’ emphasises the need to deliver fair value to customers while creating value for shareholders, which would guide the Bank’s operations. The Bank seeks to sell products and offer services which meet societal needs and are in the interest of our customers. The philosophy of ‘Fair to Customer, Fair to Bank’ and the culture to serve the end-to-end needs of customers with simplicity continued to be the underlying principle to drive mutually beneficial relationships and build trust in our brand. In line with this philosophy, the Bank, over the years, has taken various initiatives such as removing and rationalising prepayment/foreclosure charges on certain products and not selling third-party products which may have adverse outcomes for customers. Being transparent in the dealings with the customers is core to the strategy for sustainable growth.

The principle of ‘One Bank, One Team’ underscores the Bank’s endeavour to serve customers across ecosystems and micromarkets in a unified manner. The Bank has realigned its organisation and compensation structure to better support its Customer-360° strategy. Employees are equipped with requisite knowledge and skills to serve customers in line with ‘One Bank, One Team’ and provide comprehensive financial solutions to customers. The core aspects of ‘Building Team ICICI’ centre on deploying a culturally-aligned workforce in the right markets, with right attitude and skills, to deliver business strategy, while offering the Bank’s value propositions of learning and growth, enabling work environment, fair compensation and care for the employees. The Bank emphasises that at the heart of its approach is ‘seva bhaav’ which represents the Bank’s commitment to service both for its customers and employees.

The Bank recognises that the landscape is constantly evolving and with it, the nature of emerging risks. We believe that risk management must be dynamic, data-driven, and forward-looking. We seek to adopt an agile risk management approach that allows us to identify, assess and mitigate risks proactively. This includes learning from events, encouraging constructive feedback and taking remedial actions. This agile risk management approach also enhances operational efficiency and strengthens trust across stakeholders.

The Bank is committed to fostering a risk and compliance culture to ensure a balance of risk and rewards for delivering long-term sustainable outcomes. The Bank conducts business within the boundaries of law and regulations while being aligned with best practices. The Bank recognises the importance of establishing an effective framework and supporting processes so that all employees seek to exhibit values aligned to the risk and compliance culture policy. The Risk and Compliance Culture Policy establishes the guiding principles and the framework for implementation of the same. The Bank conducts risk and compliance workshops to equip employees with the necessary skills to make decisions based on the principles set out in the risk and compliance framework of the Bank.

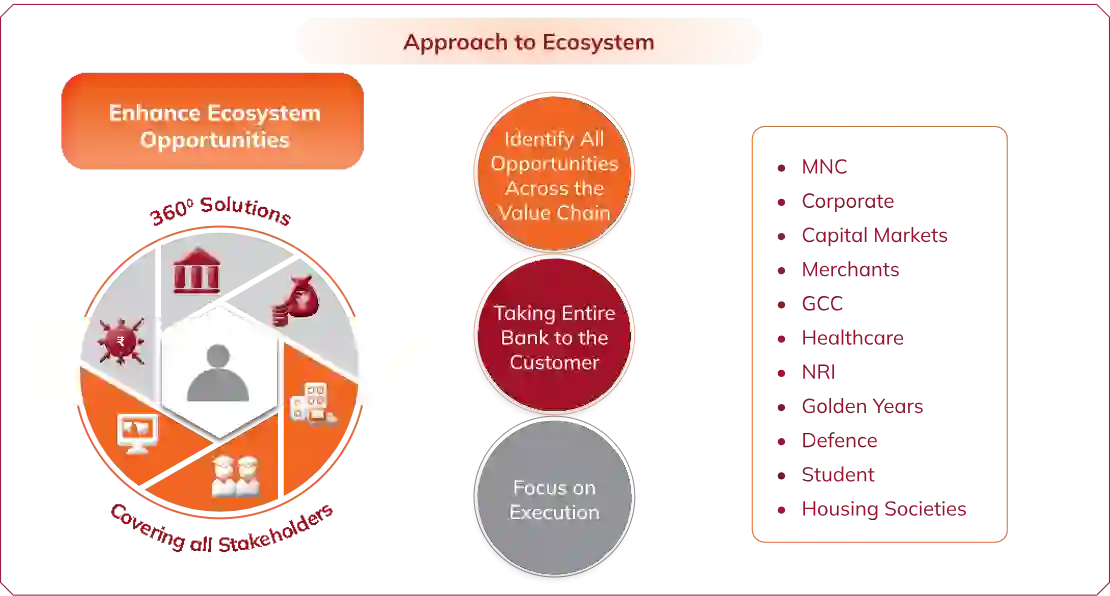

The Bank has adopted a customer-centric approach, with the prime objective of serving all their banking needs in a holistic manner. The Bank continues to focus on deepening presence and harnessing business opportunities across ecosystems and micromarkets in a unified manner. The Bank aims to grow by leveraging its long-standing franchise and well-recognised brand.

Customer-centricity is core to our strategy in growing our business and delivering customer delight. The approach begins with developing a deep understanding of customer needs, expectations and experiences. The approach is to take the entire bank to the customer and offer solutions that are holistic in nature and build trust that translates into a long-term relationship with our customers. The Bank aims to become the trusted financial service provider of choice for our customers.

As part of our Customer-360º approach, the Bank has transformed its branches into customer-oriented business centres. Business centres act as a fulcrum for coverage and provide full spectrum of offerings to the entire customer base. The Bank has restructured teams internally to better support its Customer-360° strategy by deepening leadership presence in high potential markets for faster decision-making to deliver enhanced customer experience. The Bank has further empowered frontline teams with enablers for enhancing customer engagement and providing seamless execution of services.

The Bank leverages its business centres network, digital channels, partnerships and overseas coverage of India-linked business to capture the entire Customer-360° and drive growth. The corporate office operates as a service centre and the purpose of the central team is to serve the employees to facilitate customer engagement and seamless delivery of products and services.

Business Centres

ATMs/Cash Recycling Machines

Digital Service Kiosks

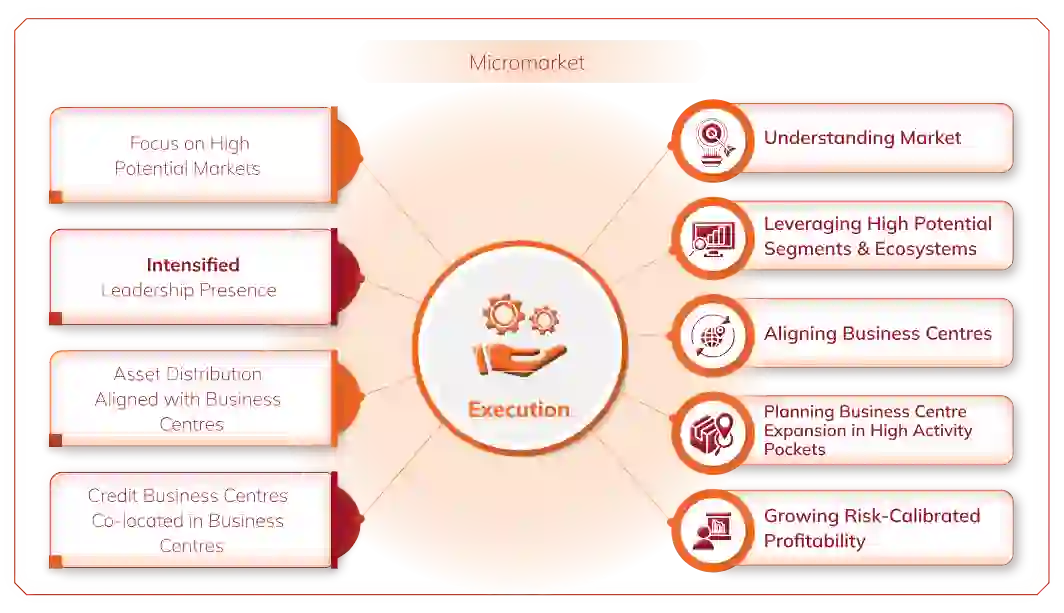

The Bank continues to uphold its customer-centric ethos through an in-depth analysis of micromarkets, leveraging data analytics and market intelligence. This comprehensive understanding empowers frontline teams to devise localised strategies with tailored propositions enabling the Bank to deliver right solutions to customers across various segments. Micromarket insights allow the Bank to focus on aligned distribution and relevant delivery models. These insights are utilised in optimising and building distribution networks to better align with customer needs and market dynamics thereby driving value creation through appropriate planning, resource allocation, channel alignment and marketing in every market the Bank serves.

V-Serv Plus has been designed to manage customer queries that may require expert intervention, where a subject matter expert guides the relationship manager and provides end-to-end faster resolutions. It acts as an enabler for employees by providing assistance on processes across products and services leading to seamless engagement with customers.

We have empowered our frontline teams with detailed local insights and structured catchment texture. Available at individual business centre level, the insights allow the teams to focus on the requirements of the catchment, develop localised strategies, allocate resources and provide customers with a personalised experience and relevant solutions.

The Bank continues to strengthen the organisational structure with ‘State Business Heads’ to capture the 360° opportunity in these geographies and ‘City Business Heads’ covering the full spectrum of the ecosystem in cities with large concentrated market opportunities. Credit Business Centres (CBCs) continue to be placed closer to important markets to facilitate faster processing and delivery.

The combination of micromarket insights and digitisation continues to drive growth and efficiency, enabling the Bank to serve more customers effectively. As of March 31, 2025, ICICI Bank’s network comprised 6,983 business centres.

The Bank’s objective is to serve all financial needs of customers and their ecosystems by capturing the entire value chain including their channel partners, dealers, vendors, employees and other stakeholders, by taking the full bank to the customer. In line with the objective of creating customer-oriented ecosystems, the Bank has developed sector-specific solutions. These solutions focus on understanding industry and sector nuances and addressing specific requirements, which help to support businesses at every step of their journey. The Bank has been providing a range of banking services to these ecosystems through a network of physical and digital channels. It provides comprehensive digital solutions for cash management, cross-border/domestic trade and supply chain finance to customers, as well as their employees. These solutions cater to broking, custodian services, real estate, education, FMCG, healthcare, NBFC, pharmaceutical and retail sectors among others.

The Bank is driving strategic transformation in the cross-border trade ecosystem by leveraging the power of digital innovation to streamline customer journeys, simplify transactions, and enhance value creation at every stage of the trade lifecycle. The Bank is building a resilient, technology-powered ecosystem that captures the entire end-to-end lifecycle of trade transactions and provides clients with seamless, secure and efficient experiences. This also enables the Bank to identify and unlock cross-selling opportunities and deliver holistic solutions across the transaction flow. The digital solutions are built on a scalable and secure infrastructure, aligned with regulatory standards and designed to enhance operational agility.

Leveraging synergies within the organisation and building partnerships across the value chain is a key focus area. Cross-functional teams have been created to tap into various ecosystems, enabling 360º coverage of customers and increasing wallet share. Partnerships with technology companies and platforms with large customer bases and operational excellence offer unique opportunities for growth, enhancing service delivery and customer experience in a safe banking environment.

The Bank aims to provide 360° solutions to the new-to-bank customers that have been acquired through various co-branded credit cards. The growth in credit card transactions was driven by higher activation rate through digital onboarding of customers, acquiring progressive profile customers and automated and effective portfolio management.

The Bank has not only pioneered the usage of FASTag for payments at various national and state highways, toll plazas but also expanded use cases to parking payments at airports, ports and malls across the country.

Over the recent years, we have witnessed the rapid evolution and growth of a vibrant startup ecosystem in India. In alignment with this evolution, the Bank has created a platform to foster collaboration and co-create innovative solutions with startups. These partnerships are carefully aligned with the Bank’s digital roadmap and are aimed at effectively addressing emerging trends in the financial services sector. Partnerships with startups are designed to unlock new business opportunities, strengthen the risk frameworks, enhance customer experience and drive operational efficiency, all leading to cost optimisation in alignment with the Bank’s digital roadmap. To nurture these partnerships, the Bank implements a structured engagement framework that ensures alignment of startup ideas, products, and services with its core strategy.

Collaborating with startups accelerates the adoption of evolving technologies at scale, such as artificial intelligence (AI), machine learning (ML), computer vision, and cloud computing. These partnerships span a wide range of business functions including retail banking, non-resident Indian (NRI) banking, corporate banking, treasury services, customer service, internal risk management, compliance and legal operations. To support these initiatives, the Bank has adopted a technology-driven approach that enables it to respond to the evolving business landscape with agility and responsiveness. This approach has delivered significant impact across domains such as digital onboarding solutions including video KYC (Know Your Customer), supply chain financing solution for anchor corporates, AI/ML powered Bank Guarantee (BG) processing, automated speech recognition and contextual conversation bot, real estate collateral management, leveraging satellite data to enhance collection efficiency and rural finance underwriting.

The Bank is continually enhancing delivery capabilities to provide quality customer experiences. While the Bank continues to invest in value propositions in line with the evolving customer preferences regarding products and services, a compelling opportunity emerges to unlock value through simplified banking. The Bank believes this will significantly enhance the capability to serve Customer-360° more effectively and provide a seamless banking experience. Recognising the imperative need of simplifying, the Bank, over the years through a series of holistic initiatives, has implemented various measures focussing on decongesting processes, driving digital transformation and strengthening delivery channels to build a seamless and sustainable delivery framework. Continuing on this journey, the Bank is implementing these holistic initiatives across its entire organisational spectrum covering technology, operations, policies, organisation structure, franchise network and distribution channels.

Offering quality banking services with simplicity and reliability is the key priority of the Bank. The Bank lays emphasis on known and assessable profiles, while maintaining stringency in counterparty selection. The Bank continues the approach of quality onboarding by selecting right counterparties including partners and service providers. By leveraging data analytics, digital public infrastructure and digital capabilities, the Bank assesses the quality of counterparties while onboarding.

Process decongestion as part of the delivery framework is an ongoing effort with the objective of eliminating complexity, streamlining operations and building efficiencies to make customer onboarding and service delivery frictionless, thereby improving the customer experience. The Bank leverages technology to automate and streamline processes, building seamless end-to-end digital journeys. By eliminating redundancies and utilising digital public infrastructure, the Bank aims to enhance operational resilience and deliver quality customer service.

The Bank is leveraging the changing technological landscape and the power of subtraction to give a Customer-360° product onboarding experience to customers along with simplifying customer journeys through initiatives such as One KYC. The Bank is working on seamless integration of 3-in-1 accounts with ICICI Securities Limited, a subsidiary of the Bank, to offer bank account, demat account and trading account simultaneously thereby enhancing the journey and ensuring faster turnaround time for customer onboarding. The Bank has intensified the focus on moving from a product-centric approach to a customer-centric banking approach and continues to rationalise product variants and remove complexities, resulting in leaner processes and reduced turnaround time. During the past few years, the Bank has rationalised the number of product variants from about 1,000 to 600. A common onboarding framework related to know your customer has been created for both asset and liability products.

The OpsServe initiative enables the Bank to consolidate operational activities at business centres and thereby releases capacity for better customer engagement. V-Serv enables the business centres and micro market teams to seek solutions to diverse customer requirements by reaching out to a central pool of internal subject matter experts. The Bank has rationalised the layers of management in its organisation structure and empowered operating teams to create flexibility and agility in capturing business opportunities.

Process decongestion initiatives have improved our response and turnaround time thereby empowering our teams to effectively serve a diverse and vast base of identified customers in a simplified manner.

In fiscal 2025, the Bank to BankTech journey has progressed with increased focus on technology platforms, embedded banking, cloud adoption, data platform, analytics and artificial intelligence. The Bank’s efforts continue to be guided by the three pillars of scalability, resilience and security across technology solutions. The technology platforms serve the objective of adding quality customer experience.

As a part of the Bank’s technology strategy, the Bank has created an enterprise architecture framework across core banking, digital platforms, data and analytics, micro services-based architecture, cloud computing, cognitive intelligence and other emerging technologies. Each facet of the architecture considers basic foundational elements of scalability, modularity, agility, availability and resilience, and the Bank is working towards making its workloads cloud native.

The Bank has over 5,500 APIs, of which over 3,500 APIs are consumed internally for communication across applications. The Bank has expanded its data centres across regions and is moving towards enabling availability zones across application clusters.

The Bank has been investing in observability platforms which are critical towards ensuring preventive and proactive responses across application and infrastructure landscape.

The fast-moving technology landscape along with various channels of interaction implies increased focus on information security across various aspects of technology beginning from data centres to the cloud to the entire technology supply chain. The Bank has adopted an integrated security architecture based on zero trust principles across data centres and cloud implementations.

The Bank lays emphasis on continuously strengthening its operational resilience for seamless delivery of services to customers. As the Bank continues to grow its business, it remains invested towards strengthening delivery systems, technology platforms and cybersecurity to sustain scalability, security and resilience.

The Bank has adopted Artificial Intelligence (AI) driven use cases across various functions to enhance operational efficiency, enable decision-making and decongest banking experience for customers. The Bank focusses on building and scaling value generating use cases of traditional AI in areas like credit risk for decongesting onboarding and straight-through decisions, marketing propensity to target offers on digital channels, fraud detection to flag suspicious transaction and customer behaviours, document extraction and classification to increase the scale and improving accuracy, image recognition etc. to gain insights, identify trends, streamline processes, automate repetitive tasks and reduce manual errors.

The Bank has invested in tools and created a framework to enable employees with the power of Generative AI for enhanced efficiency, accuracy and experience. A few examples of these use cases are:

While the Bank is working on realising the immense value of AI, the use cases are selected in a measured manner to mitigate the associated risks. The Bank continues to invest in this area to drive business solutions and harness opportunities.

The Bank’s digital transformation is centred on integrating advanced technologies and platforms to enhance customer experience and operational efficiency. While offering digital services such as mobile banking, internet banking, UPI, and digital wallets, the Bank ensures secure and accessible banking solutions for all users.

In addition to these digital platforms, the Bank’s business centres also cater to walk-in customers through various self-service devices operating 24x7. These include cash recycler machines for deposits and withdrawals and Digital Service Kiosks for services such as cheque deposits, passbook updates, get quick account credit, fund transfer and other non-financial services. This provides convenience of do-it-yourself (DIY) to customers in a digital manner and save the customer waiting time at business centres. Our business centres are able to execute majority of their retail transactions/services through digital modes.

Security has been further strengthened with features such as QR-based login for internet banking, offering a seamless and secure login experience. To support seamless service delivery, the customer service platform delivers a faster, unified interface across channels, improving the omni-channel experience and offering customers convenient access to service-related queries. Additionally, the redesigned icicibank.com website delivers a seamless, user-friendly and personalised banking experience. The new design emphasises simplicity, transparency, efficiency and convenience making digital banking more intuitive and easy to navigate.

The Bank’s iMobile app focusses on delivering a seamless, secure and highly personalised banking experience. The redesigned iMobile app enhances overall usability by offering improved control, customisation and a unified digital experience. With a user-friendly and intuitive interface, the app ensures easy access to over 400 services, including account management, fund transfers, bill payments and deposits management. The ‘My Investment Portfolio’ feature enables customers to monitor and manage their investments with ease. iFinance is a personal finance management tool for a single view of other bank accounts, promoting financial awareness through expense tracking. Enhanced features such as UPI for NRIs, smart scan, and voice search simplify transactions and boost accessibility. These advancements reflect the Bank’s commitment to delivering enhanced banking experience that evolves with customers’ growing digital needs.

The security feature of iMobile SmartLock allows its customers to temporarily block/unblock various banking channels such as UPI, internet banking, iMobile app and debit/credit cards – all with a single click. This added layer of security ensures that financial transactions are safe and secure.

To simplify customer journeys, video-KYC enables users to complete the KYC process swiftly through secure video interaction. Moreover, the re-KYC process has been streamlined and individual customers can now select the ‘No Change’ option on iMobile or retail internet banking if their ‘officially valid documents’ (OVDs) are already updated. With a single click, KYC details are refreshed without requiring a branch visit, making the process faster, more efficient and entirely digital.

The reimagined icicibank.com offers a seamless, user-friendly and personalised banking experience. Designed for simplicity and convenience, the transformed website makes it easier for all visitors to explore banking solutions. Features such as simplified product discovery, easy product comparisons, interactive calculators, and a save-for-later option help users make informed financial decisions. The Bank’s website offers digital journeys across products and services for customers and non-customers, and now is a business enablement platform. While most of the sections have been redesigned, the Bank would continue on its journey of re-designing the remaining sections of the website.

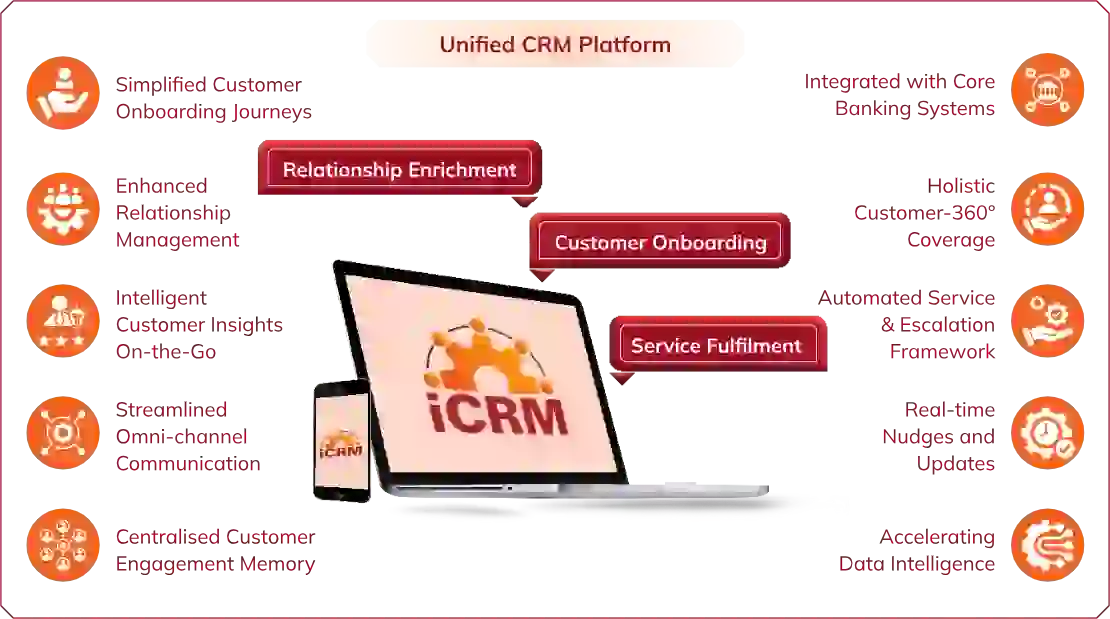

Aligned with the principle of ‘One Bank, One Team’, the Bank, during fiscal 2025, has transformed its Customer Relationship Management (CRM) platform in line with evolving customer needs, industry innovation and technology enhancements. iCRM platform is a comprehensive cross-functional unified platform across internal stakeholders such as business centres and service centres. The platform connects users, data and key customer information across the Bank which drives synergy, boosts productivity and maximises ecosystem opportunities.

Designed for both web and mobile platforms, it presents a holistic view of customer engagement history in a consolidated manner with real-time insights of key touchpoints and offering relationship managers full context of relationship to enhance engagement. The platform enables teams to better understand customer needs and preferences, engage seamlessly and offer suitable banking solutions; allowing to deepen Customer-360°, unlock new opportunities and foster a long-lasting relationship across the customer lifecycle.

iCRM platform is powered by an industry leading cloud-based enterprise solution which has enabled us in achieving agile scalability, simplified user experience and hyper-personalised customer solutions. The platform currently harnesses inputs and interactions by about 100 thousand users across about 7,000 business centres and other locations and integrating over 50 internal systems for seamless data coverage and utilisation. iCRM is an omni-channel experience across business centres, phone banking, digital channels and products to manage customer service journeys.

iLens - ICICI Bank’s Lending Solution is an industry-first, integrated digital lending platform for retail loans, covering the entire loan life cycle from onboarding to disbursement. Initially launched with mortgage products in fiscal 2023, iLens broadened its offerings to include personal and education loans in fiscal 2024, followed by the introduction of credit cards in fiscal 2025. This is expected to further enable the Bank to provide enhanced customer experience and increase its ability to capture the entire Customer-360° ecosystem in a simplified, frictionless and digital manner, thereby creating value for the customers and the Bank.

The platform offers a wide range of digital solutions, including instant sanctions for both existing and new-to-bank customers, digital disbursements (e-sign and e-stamp) and digital KYC verifications. It supports digital, phygital and physical loan applications, ensuring flexibility and convenience for all users. It is cloud-native, device-responsive and microservices-enabled open architecture, allowing seamless integration with multiple internal and external systems through APIs, facilitating faster time-to-market and adaptability. iLens includes an inbuilt customer interface, ‘TrackMyApplication’, through which customers can track the real-time status of their loan applications, submit documents, respond to queries and access various communications as well as documents.

Launched in the year 2019, InstaBIZ is all-in-one business banking application designed to meet every business banking need – anytime, anywhere. Customers can apply for loans, avail instant overdraft, manage export-import transactions, get merchant banking solutions, make instant bill and tax payments and do a lot more with the InstaBIZ app. InstaBIZ further enhanced solutions by offering analytics driven insights, enabling merchants with a deeper understanding of collection trends. The newly introduced feature - SmartLock allows the customers to temporarily block/unblock various banking channels such as UPI, internet banking, InstaBIZ app and debit cards – all with a single click. This added layer of security ensures that financial transactions are safe and secure. The Bank endeavours to provide better customer experience through continuous improvement and simplified journeys.

DigiEase, launched in fiscal 2025, is a new digital onboarding platform for business banking customers to provide seamless onboarding experience. The platform leverages integration with various public data infrastructure such as goods and services tax (GST) portal, Ministry of Corporate Affairs (MCA), bank statements and financial documents from income tax return (ITR) under single workflow for seamless retrieval and validation of data digitally, ensuring data reliability and eliminating repetitive dependency on manual verification. The platform ensures real-time checks on critical decision-making parameters, basic regulatory compliance checks and operational efficiency with reduced turnaround time in a cost-effective manner. The platform aims to provide complete visibility across every stage of the customer journey, beginning with onboarding, continuing through sanctioning and disbursement, and extending into portfolio monitoring. The advanced integration and continuous tracking ensures timely updates and a frictionless journey for both customers and internal stakeholders. With an ability to consolidate multiple digital services into a single workflow, DigiEase achieves a dual advantage: enhancing productivity by more efficient workflow and ensuring accuracy with ‘first time right approach’.

The Bank continues to lead in delivering innovative digital solutions tailored for large corporates and their ecosystems. The emphasis is centred on delivering integrated, intuitive, and seamless solutions that meet the unique requirements of businesses across industries. The Bank is continuously enhancing and adding newer journeys on cash management and trade digital platforms. The Bank ensures seamless domestic and cross-border payments and collections, efficient liquidity and treasury management, enhanced operational efficiency and higher adaptability with sector-specific relevance; such as, with a growing real estate sector and increased pace of merger and acquisitions and foreign direct investments, our Digi-Escrow platform modernises traditional escrow services by offering a fully digital experience.

The Bank addresses the evolving cross-border transactional needs of corporate customers through its suite of digital solutions such as Trade Online platform, Trade API Suite, Instant Export Packing Credit (Insta EPC), digital document management (including e-Docs, i-Docs, e-Softex and i-BOE) and digital FX and trade services (including electronic Letters of Credit (e-LC), electronic Bills of Lading (e-BL) and integrated FX solutions).

The Bank is offering solutions to meet the growing requirements of corporates for scalable and efficient supply chain finance solutions through its comprehensive suite of digital platforms. Our platforms such as OneSCF, FSCM, CorpConnect and DigitalLite deliver comprehensive digital solutions for onboarding supply chain partners, enable dealer/vendor financing in seamless manner, providing end-to-end visibility from payments to collections, automated data reconciliation and real-time dashboards in a secure and paperless transaction environment. These solutions also streamline credit assessments using smart engines that incorporate GST data, bureau checks and AI-driven algorithms.

In support of India’s growing trade ecosystem, the Bank has strengthened its trade API suite – a major step towards digitising trade transactions. It leverages advanced multithreading technology, offering clients a faster, secure and seamless experience. Our focus is to develop a future-ready digital solutions that enhances customer experience, ensures regulatory compliance, improves operational efficiency and reduce operational risk, improves transparency and simplifies processes across the value chain.

Non-Resident Indians (NRI) segment continues to be a key growth driver for the Bank’s international banking business. The focus continues to be on improving customer experience through enhanced service architecture, value propositions and seamless processes with digital at the core.

The customer onboarding process has been further simplified and key features such as optical character reader (OCR) based documentation and minimal data input with inbuilt validation has been developed. Additionally, the re-KYC journey has been simplified on digital channels. The focus is on Customer-360º banking through better customer engagement while decongesting the process complexities in an effort to improve NRI banking services.

Facilitating frictionless cross-border remittance solutions has been the core strategy for both inward and outward remittance requirement of NRIs and resident Indians. The outward remittances by resident customers to IFSC GIFT City have been enabled for online as well as through the branch network. The remittance applications have been integrated with a new system for risk monitoring thereby enhancing the safety and security. The education fees payment journey to overseas universities/colleges in US, UK and Australia has been simplified wherein the customer can seamlessly transfer the funds.

To capitalise on growth opportunities across geographies, the Bank has consolidated its retail and rural business groups under a unified structure. The Bank’s retail advances grew by 8.9% year-on-year to ₹7,172.23 billion at March 31, 2025. Retail loans accounted for 53.5% of the net advances.

The Bank’s retail business offers wide range of products and services across assets and liabilities category including lending, savings, investments along with payment and transaction banking services, lockers etc. We deliver our retail products and services through effective distribution channels of business centres, ATMs, cash recycler machines and call centres.

In addition, our digital channels and platforms have become increasingly important to our customers. At year-end fiscal 2025, we had a network of 6,983 business centres and 16,285 ATMs and cash recycler machines across several Indian states. Our 49.9% of business centres are in rural and semi-urban areas. The focus is to digitise maximum processes and other touchpoints to enhance customer engagement and provide seamless experience.

The Bank has undertaken several initiatives to offer a convenient and seamless experience to customers.

The Bank’s retail portfolio construct is based on proprietary data and analytics. The underwriting process involves a combination of key variables to assess the cash flow and repayment ability of the customer like income, leverage, customer profile, quality markers, credit bureau data and demographics. The Bank utilises multiple data points including liability and asset relationships, transaction behaviour and bureau checks along with proprietary machine learning and statistical models for credit decision-making.

The rural advances grew by 5.1% year-on-year to ₹783.40 billion as of March 31, 2025, accounting for 5.8% of the net advances. The Bank offers a wide range of products addressing end-to-end needs across the rural value chain. Key products offered include working capital loans through the Kisan Credit Card (KCC), gold loans and term loans for equipment purchase and farm development. It also provides income-generating and consumption loans to economically weaker sections, along with financial solutions to microfinance institutions, Self-Help Groups (SHGs), farmer cooperatives and small and medium enterprises engaged in agriculture-linked businesses. The rural presence is also supported by business correspondent agent network ensuring last-mile connectivity in remote areas.

The business banking portfolio comprises exposures to companies with a turnover of up to ₹7.50 billion. The advances grew by 33.7% to ₹2,633.67 billion at March 31, 2025, accounting for 19.6% of the net advances.

The Bank’s focus in these businesses continues to be on parameterised and program-based lending, which is granular and well-collateralised. The Bank has devised a comprehensive digital onboarding platform ‘DigiEase’, designed to streamline the business banking customer onboarding journey and aims to enhance efficiency, accuracy and customer experience. By leveraging digital public infrastructure and automation, DigiEase ensures that businesses can access financial services quickly, securely and efficiently.

The Bank has developed various platforms such as DigiEase to fulfil customer onboarding, sourcing and fulfilment journeys through Do-It-Yourself (DIY) and Do-It-for-Me (DIFM), through its business centres, InstaBIZ application and website.

The Bank has devised an integrated underwriting approach based on scorecard and statistical ratings model. The Bank has been strengthening underwriting process by integrating various digital tools such as bank statement analyser, bureau reports, GST, Account Aggregator based financial information etc. and has been enhancing various linked business rule engines to gather, generate and consume data. The Bank maintains a comprehensive risk management framework to manage the business banking portfolio. The Bank constantly monitors and analyses the portfolio performance to identify early signals and initiate necessary measures while maintaining portfolio within the acceptable risk threshold framework.

The Bank has also developed various platforms for onboarding customers, sourcing and fulfilment journeys through Do-it-Yourself (DIY) and Do-It-for-Me (DIFM), through our business centres, InstaBIZ mobile app and the Bank’s website. In addition, a dedicated relationship manager completes the Bank’s approach of providing full 360° coverage to its customers.

The Bank’s wholesale banking segment caters to a diverse set of clients including large private sector business houses and companies, banks and financial institutions, public sector undertakings and central and state government entities. The Bank’s domestic wholesale banking advances grew by 14.3% year-on-year to ₹2,520.51 billion at March 31, 2025, accounting for 18.8% of the net advances. The Bank also has an established franchise among Multi-National Corporations (MNCs), real estate companies, Information Technology and Information Technology enabled Services (IT & ITeS) and new-age services companies, along with the financial sponsors space with special focus on private equity funds and their investee companies. Additionally, the Bank also caters to the requirements of the capital market participants and custody service providers through digital solutions improving their operational efficiency.

The Bank follows a relationship-led strategy, aiming to build long-term partnerships with clients. The Bank aims to become a business partner to its clients instead of merely being a capital provider. With the client at the centre, cross-functional teams across the Bank work in a coordinated manner to deliver end-to-end integrated solutions to wholesale clients across their business life cycle including trade, treasury, bonds and commercial papers placements, and also to their business ecosystems. This has not only facilitated client servicing more effective, but also enabled deepening the Bank’s relations in retail accounts of key client personnel and employees through a suite of retail products. Supply chain financing continues to remain a pivotal part of the Bank’s wholesale offerings to seamlessly manage all dealer/vendor requirements.

The Bank provides end-to-end support to clients across their business life cycle including areas such as trade, treasury, bonds and commercial papers placements.

The Bank has extensively leveraged analytics to strengthen credit monitoring and portfolio performance. While new credit is extended in a granular manner to well-established and well-rated business groups, data insights through analytics is being used for portfolio monitoring and identification of early warning signals in the existing portfolio to proactively identify risk exposures. This has contributed in maintaining the resilience and quality of the corporate portfolio.

ICICI Bank’s overseas presence consists of business centres in six overseas locations and representative offices in ten locations outside India. The Bank’s overseas advances were ₹307.85 billion at March 31, 2025, accounting for 2.3% of the net advances. The Bank has an IFSC Banking Unit (IBU) in GIFT City Gujarat, an Offshore Banking Unit (OBU) in Mumbai, and wholly-owned subsidiaries in the United Kingdom (UK) and Canada.

The overseas offices of the Bank complement the India business centres by providing coverage and service to Non-Resident Indians (NRI) and India-linked businesses. The overseas offices focus on four strategic pillars, namely (a) the NRI ecosystem serving the Indian diaspora globally for their banking needs in India (including deposits and remittances); (b) the Multinational Corporates (MNC) and Global Capability Centres (GCC) ecosystem comprising foreign MNCs setting up offices in India for manufacturing/services and the Indian MNCs present overseas for their banking requirements; (c) Institutional ecosystem to capture fund flows into India through the Foreign Portfolio Investment (FPI) and Foreign Direct Investment (FDI) route and (d) Trade ecosystem comprising primarily of India-linked cross-border trade transactions.

The IFSC Banking unit (IBU) at GIFT City caters to the needs of the Bank customers based out of India by offering a range of foreign currency banking solutions spanning retail banking, corporate banking, trade finance, capital market services and the global markets ecosystem. IBU GIFT City offers savings and deposit accounts to NRI customers, in addition to loan against deposit facilities. During the year, the internet banking platform has been enhanced to offer greater transactional capabilities to NRIs across all the major currencies. In addition to simplifying the account opening process and offering online onboarding to NRI customers, the IBU has also commenced onboarding of Resident Indians under the Liberalised Remittance Scheme (LRS).

ICICI Bank is also a registered custodian, depository participant and clearing member in IBU GIFT City. ICICI Bank is a settlement banker to all three exchanges in Gift City - NSE IFSC, India INX and India International Bullion Exchange (IIBX).

The IFSC Banking unit (IBU) at GIFT City caters to the needs of the Bank’s Indian customers by offering a range of foreign currency banking solutions.

Government through adoption of technology is increasingly transitioning towards efficient financial management and transparency in its financial transactions for revenue receipts and expenditure payments. The Bank provides a range of banking services to government departments and their ecosystems, through a network of physical and digital channels. The Bank offers government customers integrated plug-n-play digital solutions, to assist them in effective delivery of services to stakeholders including citizens. The Bank is further assisting the Government in implementing various fund flow mechanisms like Single Nodal Agency Account and Hybrid Treasury Single Account. The Bank also supports the government in collection of direct & indirect taxes including income tax, service tax, customs duty, GST payments and state taxes through its business centres and digital channels. Additionally, the Bank is also extending its banking services to stakeholders within the government ecosystem, including employees and vendors for providing them convenience and seamless digital banking experience.