ICICI was founded in 1955 through a visionary partnership between the Government of India, the World Bank and representatives of Indian industry to provide medium and long-term capital to Indian businesses. As the nation took its first step towards industrialisation, ICICI played a key role in shaping India’s financial foundation – supporting enterprises, co-founding vital institutions and driving balanced regional growth.

Over the decades, it shaped the contours of Indian industry by enabling access to capital, pioneering merchant banking and leasing, and supporting technology-led ventures.

In 1994, ICICI Bank was launched to serve the evolving needs of retail and commercial banking. With the merger in 2002, a unique institution was born – combining a rich legacy in development finance with the energy and ambition of a new-age private sector bank. ICICI Bank has always been at the forefront of embracing technology and played a pioneering role in introducing and driving the adoption of services such as internet banking, ATMs and mobile apps. It brought credit to the doorstep of millions, making home, car and consumer finance more accessible and affordable.

With a 70-year legacy of building trust, we look back with gratitude and look ahead with responsibility. As we move forward, we continue to focus on creating lasting value through thoughtful innovation and inclusive growth.

Born on January 5, Industrial Credit and Investment Corporation of India (ICICI) was India’s first development financial institution in the private sector. It was set up to provide medium and long-term finance to industries to boost independent India’s growth

Allocated ₹2.16 crore – 16% of its commitments – to vehicle and component manufacturing enterprises to boost India’s transport sector

Completed sanctioning of a total of ₹100 crore since inception

Began offering foreign currency loans to partnerships and proprietary firms to support entrepreneurship

Forayed into merchant banking

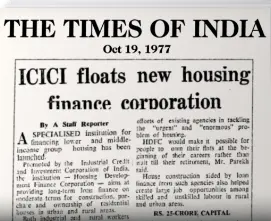

Contributed to the initial share capital of HDFC Ltd

Heralded the birth of venture capitalism in India by copromoting Technology Development and Information Company of India, which would later become ICICI Venture

Started an investment bank which would later become ICICI Securities, and an asset management arm, later known as ICICI Prudential Asset Management Company

The Bank launched Money2India for remitting funds to the country

ICICI Limited set up ICICI Lombard General Insurance

Launched first electronic toll collection in partnership with NHAI

Introduced Money2World, India’s first fully online service for outward remittances, and video banking for NRIs

ICICI Bank listed shares of its subsidiary, ICICI Prudential Life Insurance, on the stock exchanges in the country's first insurance IPO

Started a new working capital facility for MSMEs based on GST returns

Launched InstaBIZ, a digital platform for MSMEs

Introduced iLens, an industry-first digital lending platform for retail loans to offer an improved customer experience

Pledged ₹1,200 crore to Tata Memorial Centre, which was later enhanced to ₹1,800 crore

Expanded physical footprint to close to 7,000 business centres

To know more about ICICI Bank’s legacy of 70 years, scan the QR code and watch the videos